Home

Enterprise Process Intelligence with NLP and Data Engineering

Build context-sensitive knowledge management

for Unstructured Data

What We Offer?

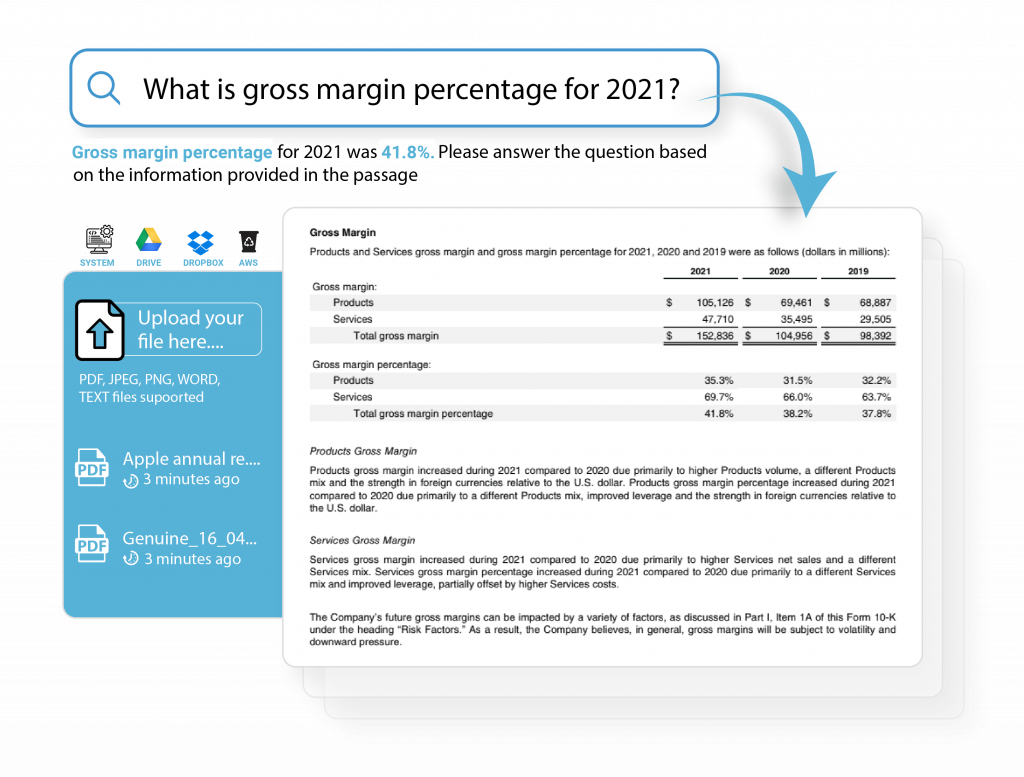

Natural Language Query

Derive relevant insights of your data by providing simple chat or voice command.Our NLQ solution enables users to make informed decisions by improved data visibility.

Document Analysis

Harness AI and ML for automated, unstructured data detection and extraction. Automate and validate documents to streamline workflows, reduce guesswork, and keep data accurate and compliant

Image Analysis

An AI-based image analysis to detect images, portions of images and extract information from it. Accurate classification of images & videos helps Businesses to make faster decisions

Speech to Text

AI powered solution to transcript and translate multilingual speech inputs.Get deeper understating of the conversations with automatic summarization, sentiment analysis, and topic modelling

Knowledge Graph

Explore Knowledge Graph — organizing data, capturing information about entities in your domain, and forging meaningful connections

Data Extraction

Intelligent AI engine to extract & transform unstructured data from multiple sources to structured insights. Derive valuable business insights from uniformly structured data repository

Use Cases

Tax statements analysis

AI system can efficiently process and analyze large volumes of financial information, automate reviewing of financial documents, ensuring compliance with complex tax regulations. System helps CPA and CA in tax statement analysis, to identify pattern and anomalies within tax statements and to detect potential errors and discrepancies. It streamlines data extraction, categorization, reconciliation process during tax preparation and reduces the manual efforts.

Explore how Recosense AI solution automates tax preperation workflows

APAC Lending firm leverages our advanced algorithms to reduce risk by 30% with faster analysis of Bank Statements & Property Assessment Reports

Use Cases

Risk & Compliance

Our intelligent ML algorithms and Natural language processing enable Banks, Credit unions, lending firms to analyze vast amounts of data in real time, helping to analyze bank statements, mortgage & property assessment reports, eligibility mapping and to identify and mitigate various risks. The system automates compliance tasks, underwriting & loan pricing, and overall lending process for enterprises.

Use Cases

Back Office Finance

Accelerate efficiency and accuracy in finance back office with AI driven process intelligence. Cut down the time spent on vendor onboarding, tax form updates, invoice accruals and customer collections. Track payables & receivables, automate data entry, record maintenance, accounting, settlements, and repetitive tasks to optimize resource allocation. Use natural language processing to analyze data from various sources & provide insights for informed decision making.

Recosense automates data capturing from financial documents to optimize operational efficiency

A leading Insurance provider achieves upto 28% improvement in fraud detection in claim documents

Use Cases

Fraud Detection

AI powered platform analyze vast amounts of data, identifying patterns and anomalies that indicate fraudulent activities in insurance claims. By assessing various data points of Provider, Payer & Patient such as claim history, medical reports, discharge summary, test details and external data sources, AI system can flag suspicious claims for further investigation. Adaptive learning of the AI system enhances its ability to detect even subtle discrepancies.

Use Cases

Issue Resolution and Damage Classification

Virtual Engineering is an AI-powered digital assistant designed for operational efficiency in Manufacturing, Supply chain and Logistics to accelerate issue resolution. The system automates learning of standard operating procedures (SOP), Product-Part correlation, Map participating entities - Vendors, Teams, Locations, Divisions etc and Financial metrics - Invoice value, Currency, Scale etc from historical records.

How a Southeast Asian Airline achieved an operational cost reduction by upto 22% with AI-powered digital assistance

How a Largest Private Sector Bank automated KYC verification with KYCSense

Use Cases

KYCSense

Experience the power of KYCSense, an advanced platform designed to automate data extraction from various document types, whether they are scanned or digital. With seamless integration into your internal system, KYCSense streamlines customer onboarding and compliance management, ensuring KYC compliance at every step.

Empowering AI Transformation

WHY CHOOSE US?

REDUCTION IN

PROCESSING EFFORTS

EASE OF

DATA DISCOVERY

DATA POINTS

PROCESSED

REDUCTION IN

TIME TO MARKET

Know more about RecoSense

Subscribe to our NewsLetter