Case Study – Tax Statement Analysis

Use Case

In this radical landscape filled with huge amounts of data, the tax firm decided to leverage AI to deliver quick and reliable services to their clients.

Explore how Recosense AI solution automates tax preperation workflows

Problem

Processing vast financial data manually burdened a prominent taxation and accounting firm in the USA, leading to inefficiencies, errors, and tedious compliance challenges. The traditional approach hampered tax statement analysis, jeopardizing accuracy and requiring extensive manual efforts from CPAs and CAs.

Solution

Implementing an advanced AI platform revolutionized tax preparation for the firm. Automation streamlined document classification, query responses, and data extraction, reducing manual efforts significantly. The system's intelligent features enhanced accuracy, compliance, and overall efficiency, alleviating the challenges faced by CPAs and CAs.

Result

The leading American taxation and financial advisory firm has seen transformative efficiency gains since integrating AI, including faster and error-free tax preparation. The platform's proficient data extraction and responsive querying have elevated service quality, solidifying the firm's position in the taxation and accounting industry.

- Manual categorization and reconciliation during tax preparation.

- Identifying patterns and anomalies within tax statements was a labor-intensive process.

- Compliance with complex tax regulations demanded meticulous attention to detail.

The leading tax firm needs powerful AI technology to streamline its tax preparation processes. The objective was to enhance efficiency, accuracy, and compliance while reducing the manual workload for Certified Public Accountants (CPAs).

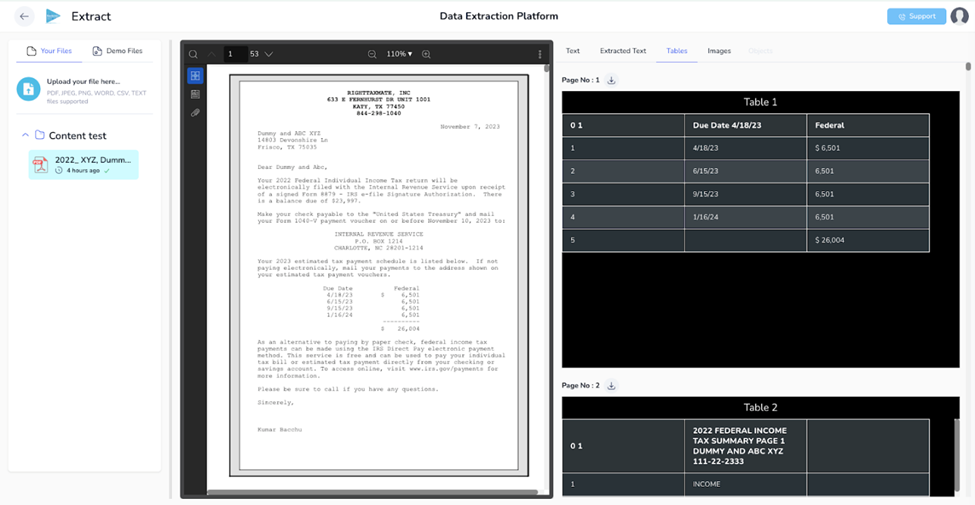

- Data Extraction and Integration: The platform’s intelligent natural language

processing (NLP) and data extraction algorithm can extract data from text, tables,

and images. It also seamlessly integrates with tax filing software, making it easy

to transition from data extraction to the filing process.

- Intelligent Classification: Customers can easily upload a variety of documents, including 1040 forms, W-2s, 1099s, paystubs, and more. The platform will intelligently classify the documents and merge them if they are uploaded separately.

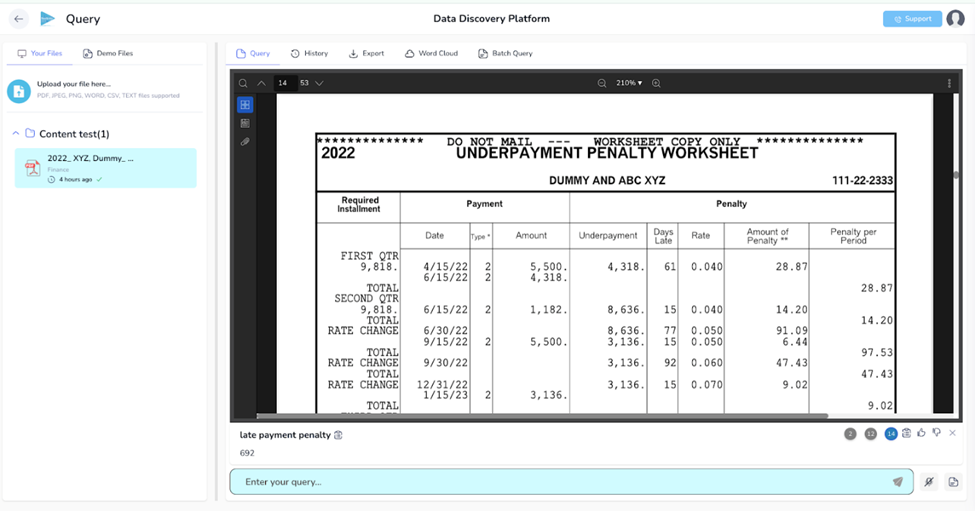

- Simplified Search with Smart Querying:

- or

multiple queries pertaining to documents. The platform promptly responded by

highlighting pertinent data points in the document, including specific page

numbers. For example, you can search for late payment tax penalty, the AI

platform will accurately fetch the value from the file and also show the page in the

file to help you refer easily. There are also downloadable query response options

to make reference and collaboration quicker and easier.