Invoices are the lifeblood of any business, containing a wealth of crucial information like customer and vendor details, order specifics, pricing, and taxes. The catch? Extracting data from invoices and matching this data from invoices to other documents can be a painstakingly slow process.

Why? Well, invoices come in all shapes and sizes, with a mix of structured and unstructured data that’s often challenging to extract manually. Imagine the hours spent sifting through these, only to end up drowning in a sea of diverse formats.

In the finance back office, time is money, and every invoice holds a universe of details. In this intricate network of numbers, customers, vendors, and taxes, extracting and aligning data from invoices is no walk in the park. It’s a crucial task that, if done manually, can be both time-consuming and error-prone. But fear not!

In this blog, we’ll dive deep into how Qsense, from Recosense Labs, reshapes your finance back office work and invoice handling seamlessly with the power of Artificial intelligence.

Let’s kickstart with a brief understanding of Qsense.

Understanding Qsense

Ever wondered how amazing it would be if interacting with your data felt as natural as having a friendly chat? Sounds mind-blowing, doesn’t it? Well, brace yourself because that’s precisely what Qsense brings to the table. With advanced Natural Language Querying (NLQ), Qsense’s NLP engine transforms your queries into a seamless conversation powered by machine learning to deliver prompt, meaningful responses.

However, invoices are a diverse bunch, arriving in various formats carrying a mix of structured and unstructured data. Manually teasing out this information not only eats into precious time but also opens the door to potential errors. Acknowledging these challenges marks our initial stride in reshaping the playbook of finance operations.

Whether it’s data analysis or extraction, Qsense steps up to the plate, executing your tasks in a mere quarter of the time. The result? Swift decisions, heightened data precision, and improved collaboration—all contributing to significant cost savings.

Transforming vendor invoice data extraction with Qsense

The heart of the platform beats with generative AI for the finance function. Picture purpose-built SmartBots, discreet and pre-packaged, donning the hat of “junior accountants.” These bots elegantly engage with systems of record, shared inboxes, and key stakeholders.

Their actions? Meticulously captured and seamlessly handed off to human counterparts when the human touch is needed.

In the finance back office, Qsense takes center stage as more than invoice manager, a backstage pass to effortlessly

- Handle vendor contracts

- Juggle accounts receivables/payables

- Give administrative overhead the boot

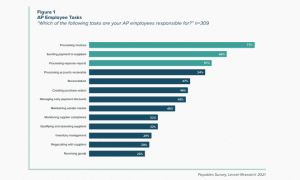

Here’s a 2021 study that clearly ranks manual entry and invoice-payment mismatch as the top 2 Accounts payable challenges:

With all that you’ve read so far, let’s delve deeper into its key features that help Qsense transform invoicing for businesses.

6 Qsense features that make finance a breeze

Yes, Qsense is a revolutionary platform for finance streamlining. But what makes it the VIP pass to smoother operations? It’s the platform’s core features that make conversations with data efficient, like

1. Cognitive OCR and the visionary world of computer integration

Here, Qsense sets itself apart with a powerful combination of advanced Optical Character Recognition (OCR) and Computer Vision. The result? A seamless extraction of information from both the structured and unstructured realms of PDF invoices.

2. Confidence-driven mechanism where precision meets learning

It’s like a virtual assistant that categorizes extraction outputs into high, medium, or low confidence scores.

- The magic happens over time. Qsense system learns, evolves, and refines these confidence scores based on user input, ensuring a continuous quest for enhanced accuracy.

- When confidence dips low, these SmartBots don’t just go ahead mindlessly. Instead, it proactively seeks human wisdom, ensuring a meticulous review process.

3. Purchase order matching precision

- SmartBots take center stage here, meticulously cross-verifying extracted Purchase Orders within the system records. Their mission? Ensuring consistency with vendors and maintaining an open status.

- Exact matching techniques on description, quantity, rate, or service lines guarantee that invoices and Purchase Orders align with precision.

4. Smart coding for managing expenses

Qsense is pretty smart with its coding. It makes sure all your business expenses go to the right place in the books. It’s like having a robot assistant for your finances, making things fast and accurate.

5. Fraud-proofing for stopping copycat invoices

Sometimes, invoices try to copy each other, causing confusion. Not with Qsense. It’s like a superhero that spots the fake bank statements using cool matching tricks so you don’t overpay or mess up your financial records.

6. Touchless processing for an efficiency boost

Qsense is all about making your work easier. It uses AI tech to recognize things on its own, so you don’t have to do everything. It’s like having a smart assistant that only bothers you when there’s something important.

For Qsense, handling invoices is about being quick, getting things right, and making your financial work a whole lot easier.

Why should you embrace the platform?

I get it. If you’re still wondering if it’s the right thing to adopt this platform for your business, let me give you four quick reasons you’ll be unable to ignore.

1. Rapid time to value for decision-making

Speed matters, especially when dealing with invoices. The Qsense platform doesn’t believe in the waiting game and wants to make things lightning-fast. It turns days of work into just a few seconds with 2X turn-around time. This is due to its pre-built integrations with leading ERP, collaboration, and email systems.

2. Purpose-built for finance

This is where technology meets finesse. Crafted with advanced AI, this platform understands the nuances of finance vocabulary and context, offering rich and reliable AI-enabled finance workflows.

3. Enhanced security and peace of mind

For this AI ally, security is not just a feature; it’s a fortress. You’re given a secure and reliable system that captures an unassailable audit trail of activities, ensuring stress-free financial operations.

4. Refocus on value-added tasks

Most importantly, if you’ve ever sought a world where mundane tasks don’t bog down finance teams, you’re at the right place. Why? Automation liberates them to refocus on reviewing extracted data exceptions and ensuring timely invoice payments. And that’s what Qsense promises and delivers in the blink of an eye.

Will this benefit you?

Now that we’re aware of the features that make the platform our data extraction powerhouse, the immediate question that arises is: “Will this platform benefit me?” I’ll let you decide that for yourselves.

1. Speed and efficiency that accelerate financial transactions

Imagine a world where data extraction is not a bottleneck but a catalyst for speed. Automation catapults financial processing into spaces faster than ever imagined.

2. Error-free task execution for crafting precision

In this context, the platform is more than a tool; it’s a master in error-free execution. By eradicating manual data entry it ensures transactions reconcile seamlessly across systems of record.

3. Visibility into cash position for illuminating the financial scenario

Real-time extraction of invoice data is a journey into the space of unparalleled visibility. It helps you dive into true accounts payable balances and expected spending levels with a clarity that transforms financial landscapes.

4. Improved compliance and governance for better financial narratives

Here, the platform becomes the storyteller, weaving accurate, complete, and timely financial reports for shareholders, vendors, investors, and auditors.

The impact? Up to 22% reduction in revenue leakage. Now, aren’t these enough to change your mind?

The future of vendor invoice data

Qsense‘s ability to reclaim thousands of hours spent on administrative tasks offers superpowers to finance teams. As we stand at the cusp of a tech-driven revolution, adopting smoother processes and super-accurate results—that’s the promise of what’s to come.

AI is evolving fast, making sure it extracts the nitty-gritty details from all sorts of invoices. Think diverse formats—AI’s got it covered! And guess what? It’s not stopping there.

What’s in store, you ask? Well, predictive analytics, friendlier interfaces and teamwork within the financial team. You’ll get to customize things your way and scale up effortlessly when your business skyrockets. Surprisingly, for you, this means saying goodbye to tedious manual tasks and hello to a world where your processes are efficient and cost-saving.

Leave a Reply