Fraud is the most significant concern for the finance industry and its clients, resulting in massive losses year after year. The majority of frauds target the retail customer segment. However, companies and, in some cases, even big institutions like banks get deliberately targeted by fraudulent activities.

Nonetheless, the finance industry doesn’t need to wait for the future to begin harnessing the benefits of AI as it now exists. The finance industry can begin deploying cutting-edge AI fraud detection systems to detect and prevent these frauds early on.

Top 4 Major Types of Fraud in the Financial Technology Sector

Here are some prevalent frauds witnessed by the financial technology sector that cause massive losses in terms of revenue and profits

1. Phishing Scams:

Phishing or spoofing is among the most prominent practices where targets are engaged by email, phone, or text message, posing as a legitimate/trusted source to entice gullible individuals into revealing sensitive data or computer network systems. The information obtained is then utilised to gather access to social media networks, bank accounts and other financial accounts, leading to financial losses.

Sending emails to customers is one method. Fraudsters aim to generate fear by reporting suspicious activities in the user’s account and urging account holders to follow the directions in the mail to safeguard their accounts.

2. Synthetic Identity Fraud:

It is yet another type of fraud in fintech lending where fraudsters get involved in activities like falsification and counterfeiting of personally identifiable information. Nowadays, it is comparatively more manageable for fraudsters to obtain personal information such as phone numbers, addresses, ID proofs, and images from social media platforms that house most of customers’ vital and susceptible data.

Despite many checks, the lack of translation and mapping between these digital and offline identities complicate matters further. The whole fintech business operates in a rapid ecosystem, which provides lenders little time to review their clients’ applications, making it simpler for fraudsters.

Such frauds necessitate the deployment of counter mechanisms like machine learning fraud detection systems.

3. Account Frauds:

Account fraud occurs when attackers get unauthorized access to an individual’s bank account and take advantage of the situation to wipe out the account balance. Victims are generally unaware that their sensitive information has got stolen until they get informed of the financial loss. Another unique account fraud occurs when clients with decent credit scores raise a huge loan amount from banks and then vanish with the money.

4. Transactional Frauds:

Such frauds are typically the result of compromised credit or debit card transactions and net-banking credentials. When fraudsters exploit stolen card information or identities to make significant purchases, the transaction time for the payments is usually relatively short for the firm to validate the user’s legitimacy. The fraud gets uncovered after the victim reports a loss of funds in their account, and the company compensates the victim while the fraudster usually stays undiscovered.

Deploying credit card fraud detection systems help curb such fraudulent activities.

2 Powerful AI Use Cases for Fraud Detection in Banking and Financial Services

1. Anomaly Detection:

This solution works on the fraud detection machine learning model trained through a consistent data input stream. The model gets trained and tested to have the requisite semblance of consistency for the contents of financial transactions, loan applications, or account opening information.

Any variations from the regular pattern get reported to a human supervisor, who can then review them. The watchdog can either accept or reject this notification, which tells the machine learning fraud detection algorithm whether or not its evaluation of fraud based on a transaction, application, or client information is correct. Further, it would teach the machine learning algorithm to comprehend that the variation it discovered was fraudulent or a new permissible deviation.

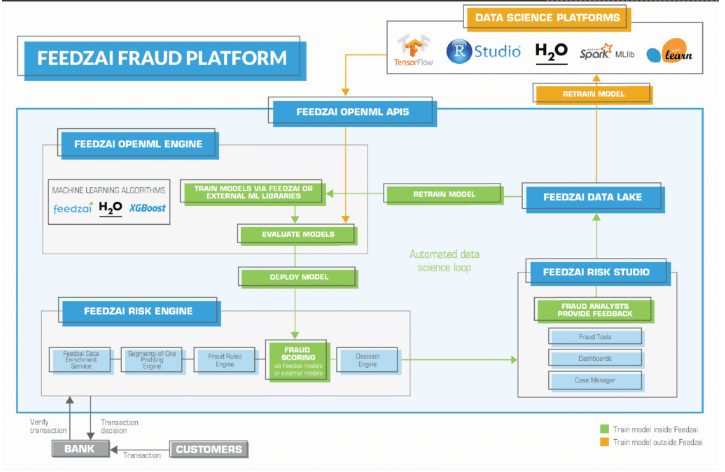

eg: A cloud platform for financial services, sells anomaly detection-based fraud detection software to banks and financial institutions. Their Open ML Engine software can assist banks in preventing fraud and money laundering by creating comprehensive risk profiles on clients and grading them based on actionable data insights.

2. Predictive Analytics:

Predictive analytics provides a discrete approach to transactional fraud detection by examining data with a pre-trained algorithm to rate a transaction on the likelihood of fraud. Banking data professionals, analysts or data scientists hired by the financial institutions will need to classify the enormous amount of transactions as either fraudulent or lawful before running them all through the machine learning model. It enables the machine learning model to identify fraud strategies employed in fraudulent transactions.

A fraudulent transaction, for example, could be for an item that the account holder had not purchased or is unlikely to. Furthermore, the geographic proximity of the person who made the purchase may differ from the account holder’s location at the time of purchase.

After being taught, the deep learning fraud detection algorithm can detect these anomalies and become more susceptible to certain data points within transactions, reporting them if the location information and the purchased item are unusual.

Top Benefits of Deploying AI in Financial Fraud Detection and Prevention

1. Performs Effective and Impactful Fraud Attack Detection

These days, Artificial Intelligence is revolutionizing how the finance industry detects fraud. AI enables them to gain a better insight into client activities by integrating supervised learning algorithms based on past data with unlabeled data. Thus, it makes AI-backed models a reliable choice for the effective identification of newly developing fraud attacks.

2. Enhances the Productivity of Fraud Analysts

AI fraud detection aids in completing data analysis in a fraction of a second and detects complicated patterns that fraud analysts cannot identify.

AI automates time-consuming processes, allowing fraud analysts to focus on crucial instances, such as when risk scores touch the peak. Since their job incorporates automated AI algorithms, fraud analysts’ work quality and efficiency improve.

Conclusion

Fraud prevention and detection is a dynamic, ongoing process, and the trick to prevention is to recognize it at the point of origin in real-time. However, it is way more challenging than it sounds. But there is no doubt that Machine learning (ML) and Artificial Intelligence (AI) algorithms provide an excellent defense to transaction fraud detection and prevention. Existing sets of transactions can be analysed before financing firms decide to go ahead with a specific application based on what they’ve learned from prior patterns and data trends.

Thus it becomes imperative to deploy AI-enabled technology in financial services from this very moment.

Leave a Reply